Eligibility

You are eligible for benefits if you work 30 or more hours per week, 1st of the month following date of hire. You may also enroll your eligible family members under certain plans you choose for yourself. Eligible family members include:

- Your legally married spouse (spouse coverage rule applies)*

- Your children who are your natural children, stepchildren, adopted children, or children for whom you have legal custody (age restrictions may apply). Disabled children age 26 or older who meet certain criteria may continue on your health coverage.

When Coverage Begins

You must complete the enrollment process within 30 days of your date of hire. Coverage is effective on the first day of the month after hire date. If you fail to enroll on time you will NOT have benefits coverage (except for company-paid benefits). Changes made during Open Enrollment are effective at the start of the next calendar year.

Employees cannot make benefit changes during the year unless you have a qualifying event such as:

- Marriage or divorce

- Birth or adoption of a child

- Child reaching the maximum age limit

- Death of a spouse or child

- Change in child custody

- Change in coverage election made by our spouse during their employer’s

- Open Enrollment period

- You lose coverage under your spouse’s plan

To make changes to your benefit elections, you MUST contact Human Resources within 30 days of the Qualifying Event (including newborns). Be prepared to show documentation of the event. If changes are not submitted on time, you must wait until the next Open Enrollment period.

Forms and Plan Documents

Click the link below to learn more about Prescription Benefits:

Empower yourself! Understand Your Benefits!

Gia is available through MVP Healthcare. Members will need to download the app at www.mvphealthcare.com/welcome/gia-by-mvp. Gia connects members to urgent and emergency care in minutes.

Look for Gia by MVP in the App Store.

Outline of Benefits and Coverage

Certificate of Insurance

Forms and Plan Information

Eligibility

Employees working a minimum of 30 hours a week are eligible 1st of the month following date of hire.

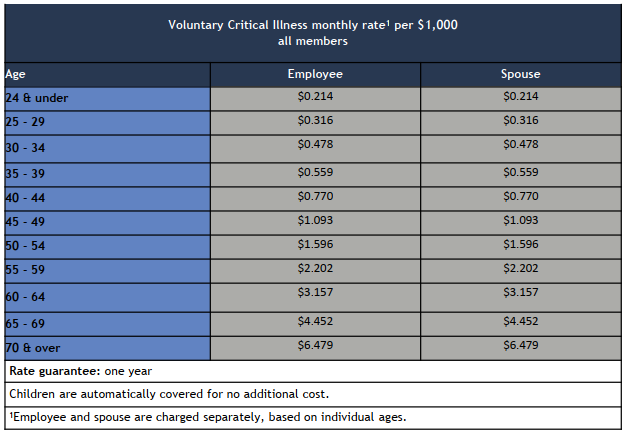

Voluntary Critical Illness

Life doesn’t always go as expected. Serious illnesses happen. And while medical insurance helps pay for medical expenses, and disability insurance replaces a portion of lost income, they don’t cover all the costs associated with having a serious illness. Critical illness insurance helps employees be more financially prepared to handle those expenses with a lump-sum cash benefit. Participating employees pay the premiums for this coverage through a payroll deduction. The following rates are in effect as of January 1, 2025:

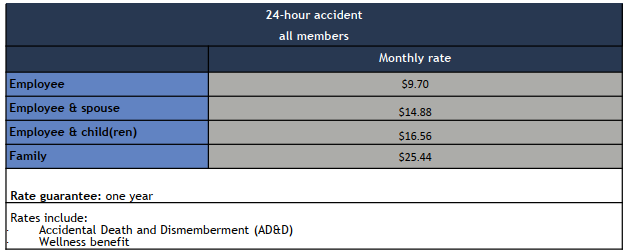

Accident

Accident insurance helps supplement key benefits such as medical and disability coverage by providing a lump-sum cash benefit. It can be used any way it’s needed to help pay expenses like medical deductibles and copayments; transportation, food and lodging; childcare; and home healthcare needs.

Eligibility

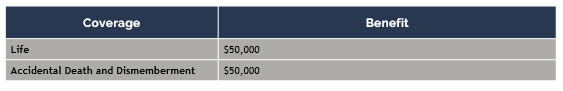

Eligible employees are automatically enrolled in Group Life and AD&D plans at the time of hire. Principal Financial Group is our carrier, and you can read the Summary Plan Description (the “Booklet”), view an overview of your benefits, check the status of a claim and retrieve necessary forms by visiting the Principal Financial website and logging in. Information is also available from Human Resources. The Firm will continue to pay all premiums for your coverage under these policies as outlined below:

Life Insurance

Life Insurance works by allowing your beneficiaries to claim a financial payout (often equal to your coverage amount) after your death. If you pass away while the policy is active, your beneficiaries can file a claim for their portion of the payout, also called a death benefit.

Accidental Death and Dismemberment

AD&D insurance is a type of life insurance that pays out when the insured dies or is dismembered in a covered accident. AD&D insurance can include coverage for fatal and nonfatal accidents involving dismemberment or loss of eyesight or hearing.

Eligibility

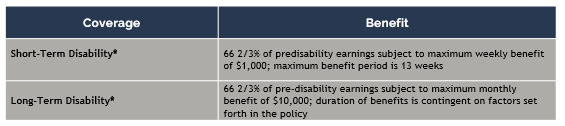

Eligible employees are automatically enrolled in Long-Term disability and Short-Term Disability plans at the time of hire. Principal Financial Group is our carrier, and you can read the Summary Plan Description (the “Booklet”), view an overview of your benefits, check the status of a claim and retrieve necessary forms by visiting the Principal Financial website and logging in. Information is also available from Human Resources. The Firm will continue to pay all premiums for your coverage under these policies as outlined below:

Eligibility

Employees working a minimum of 30 hours a week are eligible 1st of the month following date of hire.

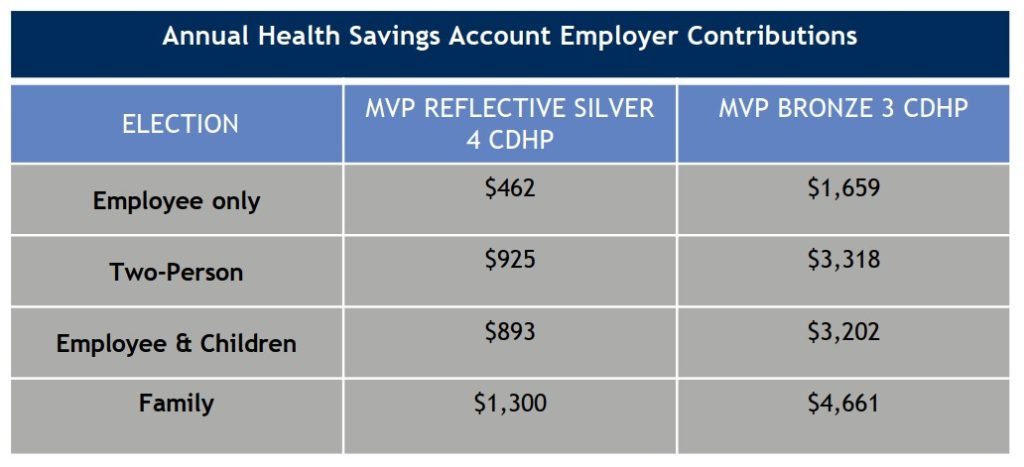

Health Savings Account:

A Health Savings Account (HSA) is a personal savings account that lets you set aside money to pay for qualified medical expenses on a pre-tax basis. Because it offers potential tax advantages and money within the account can be invested, an HSA can be used to pay for both near-term medical expenses and expenses in retirement.

How it works:

You can withdraw funds from an HSA tax-free to pay for qualified medical expenses like deductibles, copayments, coinsurance, and some dental, drug, and vision expenses.

- Tax benefits – Contributions to an HSA are tax-deductible, and interest earned on the account is tax-free.

- Portability – You keep your HSA even if you change plans or retire.

- Eligibility – You can be eligible for an HSA if you enroll in a High-Deductible Health Plan (HDHP).

The HSA contribution limits for 2025 are $4,300 for self-only coverage and $8,550 for family coverage. Those 55 and older can contribute an additional $1,000 as a catch-up contribution. Keep these limits in mind when choosing bi-weekly contribution amounts.

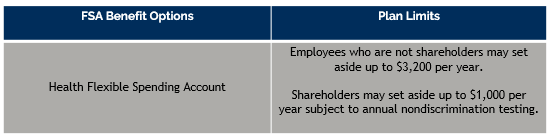

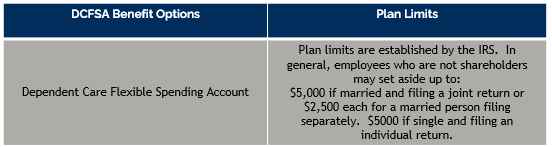

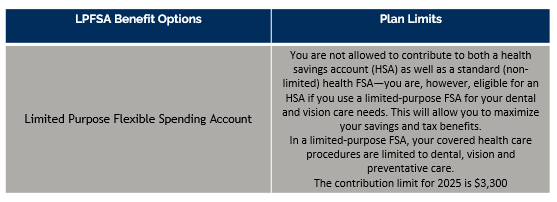

Health & Dependent Care FSA

To encourage employees to manage health proactively and to keep benefits as affordable as possible, we offer Flexible Spending Accounts (FSAs) with debit cards. All employees who are eligible for the Firm’s group health insurance coverage may participate, although different plan limits apply to shareholders. The FSA benefit allows you to pay for certain qualified out-of-pocket medical, dental and vision expenses as well as qualified dependent care expenses with pre-tax dollars, which lowers your tax liability. Participating employees will elect the amount (within plan limits) that you would like to set aside for the FSA during the 2025 plan year, and your FSA contributions will be made through a pre-tax payroll deduction. When you incur an eligible expense during the year, you can use your debit card for payment or submit a claim for reimbursement. Plan participants may carry over up to $660 of your unused health FSA balances remaining at the end of a plan year. Any remaining balance more than $660 will be forfeited, so each year you should plan carefully and try to use all the money set aside in your health FSA for eligible expenses incurred during that year.

The Richards Group has entered into a partnership with Health-E Commerce, also known as the FSA Store. This gives you access to hundreds of products that have been pre-vetted & approved for use with your Flexible Spending or Health Savings Accounts.

Did you know you could use your FSA to save money on everyday health essentials like baby health items, health trackers, pain relief products and more?

Here are just a few benefits of using the FSA Store:

- No Receipts Needed

- 2,500+ FSA Eligible Products

- 100% Eligibility Guaranteed

- Skip the claims process when you use your FSA card

To see a complete list of FSA qualified expenses CLICK HERE.

This partnership also allows access to their Caring Mill products. Caring Mill is a line of premium healthcare products that support a healthy lifestyle and on average is priced 30% less than branded equivalent products.

With every Caring Mill purchase, a donation is made to Children’s Health Fund, providing necessary treatments to thousands of children in need, throughout the United States.

Curious what your FSA/HSA dollars can cover? Simply enter the product you are looking for in the eligibility list below.

Pets Are Family

Pets are good for our health and our hearts, and they rely on us for love and care. Our plans can cover all types of pets, including exotic pets, elderly pets and even pets with pre-existing conditions.

Better Pet Healthcare

Veterinary care is expensive, and most pet owners pay for veterinary services out-of-pocket. Healthcare decisions for pets should not be made on financial considerations alone.

Pet Benefit Solutions

Every pet family has different needs. We offer comprehensive insurance coverage, wellness plans, savings plans and Rx plans so employees can choose what works best for their pets. Participating employees pay the premiums for this coverage through a payroll deduction. The following rates are in effect as of January 1, 2024:

- Total Pet Plan rates are guaranteed for a period of 1 year.

- Total Pet Plan: $11.75/month for one pet; $18.50/month for a family plan (2+ pets)

- Wishbone Pet Insurance is a direct bill benefit, and individual plans renew on the policy renewal date.

- Any premium changes will be communicated directly to employees.

Wishbone Pet Health Insurance

Your pet deserves the best care, and you shouldn’t hesitate to give it to them! From one-time accidents to chronic illnesses, Wishbone has your back with a variety of options. Wishbone Pet Insurance is a pet health insurance program offered by Pet Benefit Solutions. Policies exclude pre-existing conditions and are subject to waiting periods, deductibles, co-insurance, benefit limits, and exclusions.

Wishbone Pet Insurance is a direct bill benefit, and individual plans renew on the policy renewal date. Any premium changes will be communicated directly to employees.

Contact Us

Wishbone Pet Health Insurance

800-887-5708

401(K) Savings Plan

Employees are eligible to participate in the Firm’s 401(k) Savings Plan (the “Plan”) after completing six months of service. At that time, employees may begin making deferral election contributions to the Plan. The Firm will begin making safe harbor nonelective contributions on behalf of eligible employees on the first day of the month following the completion of one year of service. For Plan purposes, one year of service is a twelve-month period during which you work 1,000 or more hours for the Firm.

Employee Deferral Election

As an eligible employee you may elect to defer amounts from your compensation into the Plan on a pre-tax basis up to the maximum allowed by law each year instead of receiving that amount in the form of salary or wages. You may also designate some or all your deferral contribution as a Roth 401(k) deferral contribution, in which case your contribution amounts will be taxed as more fully described in the SPD.

Employee Contributions

Safe Harbor Contribution – For the Plan year beginning January 1, 2025, and ending December 31, 2025 (the “Plan Year”), the Firm will make a safe harbor 401(k) non-elective contribution equal to 3% (not less than 3%) of an eligible employee’s compensation. Eligible compensation for computing the safe harbor contribution is your taxable compensation for the Plan Year reportable by the Firm on your IRS Form W-2 (excluding certain reimbursements, expenses benefits, and other forms of compensation more fully described in the SPD and the annual Safe Harbor Notice).

Employee Assistance Program (EAP)

The EAP provides you and your family members with 24-hour access to counselors for support, guidance and resources for everyday work/life issues, such as parenting, eldercare and stress management. You also may take advantage of in-person counseling sessions with a local counselor when warranted, as well as telephone access to legal counsel. Our benefits cover up to 3 face-to-face counseling sessions per employee per year and numerous resources available through Magellan’s website. You may also call Magellan’s Provider Services Line at 1-800-788-4005.

Employees also have access to an Employee Assistance Program (“EAP”), Travel Assistance and Voluntary Term Life Insurance through Principal Financial (www.principal.com) or 800-986-3343.

How to get started:

Getting the help you need, when you need it, can result in you leading a happier, more productive life.

- Give your program a call at 1-800-356-7089 and get connected with the right resource or professional.

- Visit the member website at MagellanHealthcare.com and set up a new account to complete the simple onboarding process. You’ll need to enter your name, physical address and company information, as well as answer a few questions, to complete registration. You can search for a provider without logging in, but to access all services and information, you will need to have an account and sign in. Having an account also allows the member dashboard to populate with events, services and resources that pertain to your needs.

Key features:

- You do not need to enroll. The EAP is available to you and your household members at no cost.

- Services are completely confidential and provided by a third party.

- You can call anytime 24/7/365, and the EAP will help get you on the right path to meet your needs.

The EAP can help with a wide range of issues. Explore services:

Explore services:

- Counseling – Help for challenges such as anxiety, grief, depression, relationships and more. Meet with a counselor in-person, by text message, live chat, phone or video.

- Lifestyle Coaching – Set, define and reach your goals with the help of a coach. Receive individualized support to handle work stress, parenting, weight loss and more.

- Digital emotional wellbeing program – Interactive activities and education for overall wellbeing. Get help managing anxiety, stress, depression, pain, sleep, alcohol, drug misuse or recovery and more.

- Work–Life web services – Find resources for childcare, elder care, discounts and more.

- Financial wellness, Legal services and Identity theft resolution – Access to free consultations and resources.

- Member website – Get more information on all the services available.

-

- Use the Provider Search to find care in your area.

- See the latest news on trending topics like building resiliency or managing finances.

- Explore the Discount Center.

- Browse articles, webinar recordings, videos and self-assessments on a wide range of topics including anxiety, childcare, depression, elder care, parenting, relationships, stress management, substance misuse, work-life balance and so much more.

GradFin (Tuition Repayment Assistance)

GradFin is a new employee benefit program that is revolutionizing the way employees can reduce their student loan debt or obtain funding to go back to school. Utilizing Primmer’s relationship with The Richards Group, consultation services provided through GradFin are provided free of charge.

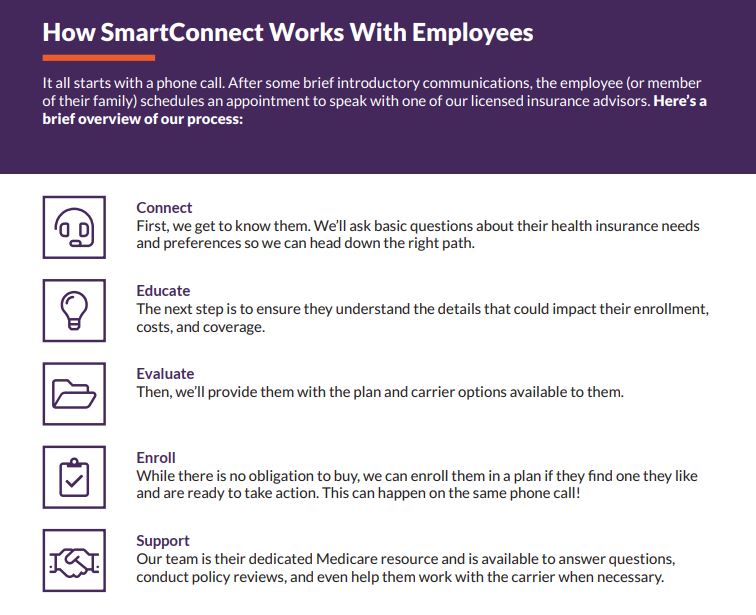

The Richards Group has partnered with SmartConnect™, an exclusive, no-cost program created specifically to connect Medicare-eligible working adults to the world of Medicare benefits. Whether you plan to continue working or are transitioning to retirement, SmartConnect tailors solutions designed around your needs. Agents will provide an unfiltered view of the entire range of options and prices available.

SmartConnect Contact Information:

For more information or to get started, please click on the following link https://gps.smartmatch.com/therichardsgroup

1-833-502-2747 | TTY: 711